Something is going on in Cyprus. It’s been difficult for us to figure out the details due to the tough conditions: 15 years later we still can’t figure out how to use Bloomberg for anything other than financial AIM (we bloom dudes all day long); ever since Google murdered Google Reader (future murdered, if you’re being technical or pedantic, you bastard), we’ve forsaken all of Google’s products and services — as it turns out, the internet is basically useless without Google, especially since our fallback, Lycos, doesn’t work nearly as well as when we originally designed our internal disaster recovery redundancy redundancy plan.

We’ve had to use phones to talk to people (not in person, thank god) about the situation. Our determination: it’s “not good.” Especially for people that appreciate the service that banks provide wherein they hold your money for you, write it down on a list or whatever, and then give it back to you when you ask for it. This service that banks provide is known as “banking.”

As it turns out, this romanticized version of banking service was not how it always worked out. Sometimes there were panics or runs and you couldn’t get your money out. These panics used to happen from time to time, until most of civilization adopted deposit insurance schemes wherein a national government insures all depositors in a nation’s banks up to a certain amount. Deposit insurance is one reason why North Korea’s banking industry has been so stable the last decade; the other reason is that North Korea’s banking industry doesn’t exist (known in some circles as “Too Small To Fail,” research to follow).

Ok, so now this whole banking thing is fine, right? Panics hardly ever happen now, so no worries? Yes! But also, unfortunately, no. Because markets are weird and adaptive and respond to incentives, and regulations of various kinds have made it such that banks had (and have!) an asymmetrical relationship with risk AND incentives to do things like lend gobs of money at low rates to Greece because it’s “riskless.” In an unforeseeable “Grek” tragedy, these things have led to banking instability, one that deposit insurance can’t address.

But there is an even better way to ensure banking stability, even better than deposit insurance or banks not making terrible loans with no repercussions. Banks can simply take their depositors money. This is the most exciting Zimbabweconomic development since Zimbabwe itself pioneered even freer trade. So while the situation in Cyprus is “not good,” you could also say it could lead to something “really great.” Like this:

The core problem facing the world is banking instability. But right inside their own vaults and on their own electronic ledgers, these banks have the means to enhance their own stability. In Cyprus, they wimped out and deployed half measures by taking something like 40% or 50% of depositors’ deposits. Wouldn’t the banks, and in turns the world, be a lot more stable if they took 100% of depositors’ deposits? This would maximize banking stability and minimize banking instability’s impactfulness on bondholders. We’re not scientists, we’re economists, and this looks Mugabe Optimal to us.

Recommendation: We recommend that banks seize all of their depositors’ deposits. Be sure to call the act something harmless like “lollipops” or “haircuts” or “puppies”.

“The bank bestowed 100% puppies to all its fortunate, stability-loving customers.”

“I went into get my money from the bank and got a trim! I look great! Thanks, Banco Unioni di Cyprus.”

This seizure will be Mugabe Optimal according to the paper we won’t publish featuring the proof we didn’t do about the assumption-heavy autarky we modeled using the math we mostly made up.

Given the world’s likely move to a Mugabe Optimal banking state, Long or Short investors ought exercise caution when depositing money in anything called a “bank.” Safer places for your money include Dangerous Fund I, Dangerous Fund II, any mattress, any resource, any box, any location in your house either hidden or in the open, on your person, hanging out of your pants pocket, pre-buying with your drug dealer, a stripper’s g-string, diamonds, real estate in Zimbabwe, a vanity license plate for your mega-yacht, a vanity license plate for your deep-sea submersible vehicle (the new mega yacht, research to follow), a tar pit, that thing from Star Wars that ate Boba Fett, etc.

POSTED: 04/2/13 11:45 AM

Comments Off on Cypriot Experiments: Mugabe Optimality in Banking

Might there be a higher power than the Yellen?

Might there be a higher power than the Yellen?

Tinderbox Capital LLC, an incendiary investment management firm and subsidiary of Long or Short Capital LLC, announces its third fund, Diversifying Fund I.

Tinderbox Capital LLC, an incendiary investment management firm and subsidiary of Long or Short Capital LLC, announces its third fund, Diversifying Fund I.

Tinderbox Capital LLC, an incendiary investment management firm and subsidiary of Long or Short Capital LLC, announces its second fund, Dangerous Fund II.

Tinderbox Capital LLC, an incendiary investment management firm and subsidiary of Long or Short Capital LLC, announces its second fund, Dangerous Fund II.

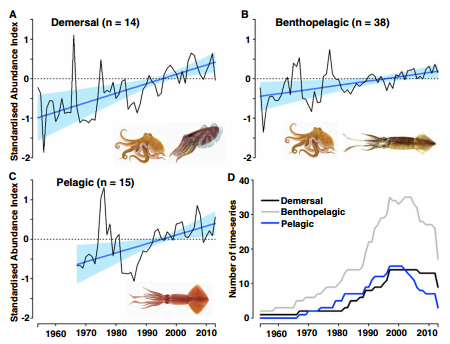

Net-net women are a fantastic investment (with the caveat that if the baby making monopoly is broken up or the cephalopods enslave the human race (2026 is our best estimate for the latter), multiples will come in substantially). So we do not begrudge the me-too boutique bank/research firm, Bank of America (NYSE:

Net-net women are a fantastic investment (with the caveat that if the baby making monopoly is broken up or the cephalopods enslave the human race (2026 is our best estimate for the latter), multiples will come in substantially). So we do not begrudge the me-too boutique bank/research firm, Bank of America (NYSE: