January 6, 2016

How to Win the Lottery (You Already Did)

ABC News shows us how to win Powerball.

About 70 percent of past winners used Quick Picks, the computer system that spits out numbers, according to the official Powerball website.

“Does this mean that you are more likely to win with a computer pick ticket? Maybe,” the site states.

…

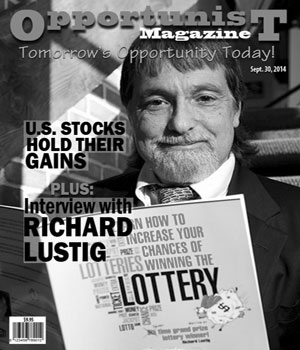

If you play the lottery regularly, it is important to pick your own numbers and to stick to that same combination every time you play, lottery expert Richard Lustig said. “Never ever, ever change those numbers,” Lustig told ABC News.

Lustig knows a thing or two about successful lottery bids because he has won seven lottery game grand prizes in his lifetime. So he plays regularly and has theories about ways that people should research their numbers and determine whether their selections work.

But, for more infrequent players who are only drawn in with extreme jackpots, there is less of a science involved

Are Certain Numbers Luckier Than Others?

If you opt to pick your own numbers, you might want to include 8, 54, 14, 39 and 13. These numbers are the most frequently drawn numbers, according to an ABC News analysis of past winning Powerball tickets.

High functioning numerates scan this piece and have the same reaction: yep, this all checks out. Some numbers do naturally occur more than others; the ABC analysis neglected 19. Randomness is lies. Does this mean you are more likely to win the lottery with a random number generated by a computer? YES.

Heck, this article is probably old news to most of you since most LoS readers also make Richard Lustig’s Winning Lottery Method a daily read. Additionally, about half our readers are graduates of Richard Lustig’s NEW Lottery Winner University and the other two thirds are PhDs.

We excerpt thusly:

My name is Richard Lustig and I live in Florida [editor’s note: A Florida Man]. What I am offering is not a joke. I have created a method that I and members of my family use that has enabled us to WIN several lottery game GRAND prizes.

My method is very easy to use and my book is very easy to understand. I PURPOSELY MADE THE BOOK SHORT AND TO THE POINT. IT IS 40 PAGES OF INFORMATION – NOT SOME 200 TO 300 PAGE BOOK FILLED WITH A LOT OF USELESS WORDS. You don’t need a dictionary or a calculator to understand my method. And my method will work with any type lottery games (scratch tickets or number games) in any state or country.

Recommendation: Long you, dear reader, because articles like this should remind you that you will always have a job. Always, man. You have won the real lottery. Congrats.