October 23, 2015

Zambinomics, the new Zimbabwenomics

Might there be a higher power than the Yellen?

Might there be a higher power than the Yellen?

Zambia will hold a day of prayer and fasting on Sunday, with bars shut and football matches cancelled, to seek divine help over the country’s currency collapse and dire economic woes.

Food prices have soared and crippling power shortages have also been triggered by low water-levels in Lake Kariba, where hydropower plants supply much of the country’s electricity.

“God is a god of miracles and if we ask him, he will bless us and the kwacha shall be restored to its former strength and the prices of goods shall again go down,’ Bishop Simon Chihana…told AFP.

Paid up subscriberholders know Zimbabwenomics has been revolutionizing economics and investing alike ever since humanitarian/economimst Robert Mugabe first launched the field. Every kleptocrat and savvy investor that heeded our related recommendations has gotten richer than Croesus. You’re welcome.

Well money never sleeps, and we’re totally money, so neither do we. We’ve spent the last several years traveling around the Dark Continent (Wikipedia describes the Dark Continent as “A phrase in declining usage to describe Africa” — I can’t imagine why that usage has been in decline, seems ok to me) to uncover a new strain of disruptive economics, Zambinomics. The new field is a natural iteration of Zimbabwenomics’ cornerstone, Mugabe Efficiency Theory:

Per MET, when supply is too dear, government fiat is needed to price it where demand can buy it. Problem solved, supply and demand clearly balanced and the cosmos is once again in order.

A Zambinomic approach would be that if supply is too dear, you pray to God and she makes supply cheaper. Or if your currency has too much flation, you get everyone together and pray the flation away. In Zambinomics, government fiat is superseded by the highest authority there is — God (or Gods or even the Flying Spaghetti Monster for all our Pastafarian readers).

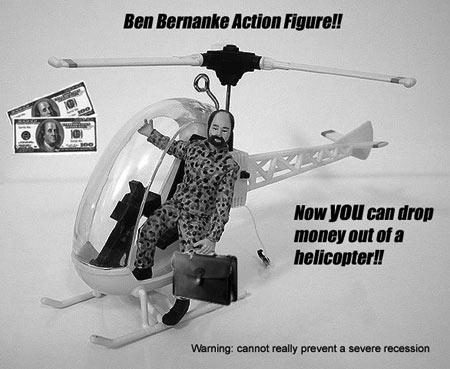

Recommendation: Long gone will be the days of everyone hanging over all the cryptic gobbledygook that comes out of the mouths of Greenspans, Bernankes, and Yellens. In again will be the days of everyone hanging all over the cryptic gobbledygook that comes out of the mouths of virgins stoned out of their minds on cave gas. That is as it should be. Long ARG (NASDAQ: ARG) and all makers of cave gas.

I’d like to dedicate this post to Sage Kelly who said we should start writing more often. Sage, we heard you loud and clear 7 months ago and as you can see, we’re on it.

Zimbabwenomics is mainly a field of economic study, but that doesn’t meant its guiding principles can’t be pragmatically applied to create solutions for any problem (note: if there is no problem, Zimbabwenomics can utilized in creating one). Robert Mugabe was facing a difficult re-election as president of Zimbabwe in the elections earlier this year, one that had seen tension, vitriol and internecine tribal conflict on a scale almost matching that of the US Democratic Primaries. But Mugabe understood a fundamental concept that his opposition and international haters failed to grasp, namely the inherent advantageous position that a Zimbabwenomic analysis of his candidacy revealed.

Zimbabwenomics is mainly a field of economic study, but that doesn’t meant its guiding principles can’t be pragmatically applied to create solutions for any problem (note: if there is no problem, Zimbabwenomics can utilized in creating one). Robert Mugabe was facing a difficult re-election as president of Zimbabwe in the elections earlier this year, one that had seen tension, vitriol and internecine tribal conflict on a scale almost matching that of the US Democratic Primaries. But Mugabe understood a fundamental concept that his opposition and international haters failed to grasp, namely the inherent advantageous position that a Zimbabwenomic analysis of his candidacy revealed. Good morning. Stakeholders who have read our reseach piece on

Good morning. Stakeholders who have read our reseach piece on