The Llama of Lame

by Johnny DebacleTo: The Fed

From: Long or Short Capital

Re: You suck

Dear the Fed,

You suck. You don’t have a backbone and as a result you are slowly and very surely making our country and our currency irrelevant. Usually the masses rebel and bring down great empires but luckily for us democracy fixed that problem. Unfortunately, democracy can’t fix how lame and fickle you are and so you will be our ruin.

A few things to tell you:

1) Inflation isn’t 2% like your pathetic CPI ex-Food & Energy says it is.

First of all, as far as I can tell food and energy are the only two items you should NEVER exclude from an inflation index. Tell your wife and kids they can have everything in the consumer basket except food and energy and you will quickly see that they are actually the two MOST important and indispensable factors in the CPI. You can find substitutes for, or go without, everything in the basket EXCEPT those two.

Secondly, stop using “Seasonally Adjusted Intervention Analysis” it’s as sketchy as the Seldom-Accepted-Accounting-Principles (SAAP) we use to cook the books here at LoS. I mean writing a computer program to automatically remove any items in the basket which deviate meaningfully from the previous year? Isn’t the point of the data to SHOW the change versus the previous year not hide it? Oh, I found the list of items that you’ve adjusted for and it’s embarrassing.

The majority of adjustments remove price increases with much less frequent adjustments for price declines. You’ve basically left dairy products out of the index for the last 5 years citing outrageous one-offs like “a generally tight cheese market” as justification for this. And as if reporting a separate ex-energy index wasn’t enough you’ve statistically intervened to remove the effect of higher energy prices even in the index that’s supposed to INCLUDE energy. In one outrageous case you removed the effect of fuel oil for three months in March 03 and the reason you cited for the “abnormal” move was the “end of winter,” yeah I was surprised as sh-t when winter ended in Spring 03, it was wild! For a real measure go back to the old method, you’ll see inflation is at least double what you’re reporting.

2) Grow a spine you slimy invertebrate

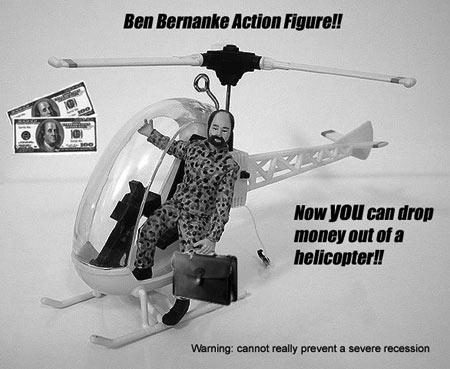

The market has a memory. Over the past 15 years you trained us to believe that no matter how much risk we take, and how much we lever that risk, if anything really scary comes down the pike then you will bail us out. Now we all run around like reckless, spoiled 16 year olds bidding up the price of anything we can get our hands on and not worrying about consequences because daddy (Greenspan) and mommy (Bernanke – that’s right you’re spineless AND a girl) will get us out of any trouble we get in. Well you’re only making the problem worse and we aren’t learning anything so we’ll continue taking stupid leveraged bets creating bubble after bubble so you can tip-toe around trying not to pop any of them.

3) You’re lying to yourself if you think we still have real GDP growth in this country.

I challenge you to find one measure of wealth OTHER THAN THE DOLLAR which shows the US economy as worth more now than in 2001. If I wanted to buy our country it would cost me 30% fewer euros today than it did in 2001, it would cost me less bars of gold, less barrels of oil, less ounces of copper, less btu’s of natural gas, less cubic feet of lumber, less of almost anything that has intrinsic value. Yet you keep reporting GDP growth, why? Because your quick fix is to effectively print more money so that in dollar units everything is getting more “valuable”. But guess what, to the 95% of the world that doesn’t use dollars the true value of the US economy has been shrinking, rapidly.

It’s like a company doing a 5 for 4 reverse stock split every year and claiming to have 20% eps growth, you haven’t changed the earnings just the units those earnings are measured in. The rest of the world is telling you our country is worth less by massively selling our currency and you still naively think we’re growing value – I feel like I’m at a gathering of the flat earth society or in Zimbabwenomics 101.

This will come back to bite you but not nearly as much as it bites us. The cheaper the dollar gets the more expensive all our imports get, inflation will rise faster than you can statistically manipulate it and when that happens expected inflation goes through the roof (which as you yourself have pointed out many times is by far the most serious threat to economic existence). Then the only way out will be interest rate increases as swift and severe as all the cuts have been. All the bubbles will pop at once and then we’re really in for it. Maybe it’s 10 years away but there’s a toll collector at the end of every free ride.

When will you learn that recession is ok? It’s actually healthy, it’s the cycle, it’s how things have worked for a thousand years. Trying to prevent every small recession is going to end in one huge recession (ie. depression) and no one will trust you anymore which is a much bigger problem. No economy in history has ever been able to successfully inflate its way to health, this won’t be any different.

Benny, I know you had to trade in your hypothalamus and spine to be fed chairman and now you biologically over-react to everything and are incapable of standing up straight when confronted by bully-morons like Kramer. But I’m hoping you at least still have your brain. Before you had this job all your published research showed that central banks should strictly target inflation and should be ignorant of asset prices. You had good reasons for this conclusion, don’t forget them.

Subprimely,

Long or Short Capital Management

Huge applause to you guys. You summed up my frustration succinctly.

LoS must find a way to get this to that Kramer blowing suck hole Bernanke.

One of your best articles.

LoS? I’m guessing you were short.

Exchange rates fluctuate. A weaker dollar has been required to bring down the current account deficit. Opposing views are necessary to provide a two-way market, but honestly, everything will be ok. The RoW aka China is not taking over. If you honestly think the whole system is flawed and the US is going to hell in a hand basket, buy some 1000 puts (or 2000 calls if you really believe we’re headed for hyper-inflation) in the s&p for next to nothing, line your baseball cap with the tin foil so people can’t tell you’re a conspiracy theorist on sight and soldier on.

Is that Autotext that popped up when you type in “Bull POV” in Word?

We are actually very long Limes and Camels in the current climate. Also long Legs (still have room to run).

Nice write. Can’t wait to see what LoS has to say when Benny starts buying out on the curve because he doesnt “agree” with it’s opinon, and well, it’s just not allowable to have prices going down.

It makes me uncomfortable when the same analysts that bring us the “Short Girl-on-Girl” recommendation also have this… surprisingly-lucid bear-case for the current market.

Are you saying you are long Girl-on-Girl? In THIS market? Are you crazy? Completely over bought.

“a 1,000 years”

I’m short plural disagreement, long the Queen’s English.

Amen brother! Contact the Fed Board via http://www.federalreserve.gov/feedback.cfm (post the article)

or snail mail:

Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue NW, Washington, DC 20551

I suggest submitting this article both ways. Maybe one will make it through.

thank you johnny debacle.

this crosses political lines….

id short the whole market, but whats that keynes quote? oh yes, markets can stay irrational longer than you can stay solvent.

inflation will rise faster than you can statistically manipulate it

Impossible!

Short 50bps cut, short Ben, short USD, long toy helicopters so long as they are made in china

‘The majority of adjustments remove price increases with much less frequent adjustments for price declines.’

Wahhhh! Simply not true. For the past 5 years the gold bugs whined how Oweners’ Equivalent Rent did not properly reflect the huge increases in housing price inflation.

Now that housing prices are plummeting, OER is positive and rising! Rent is a much bigger portion of most people’s expenses than cheese. Where’s all the comments about OER now?

‘First of all, as far as I can tell food and energy are the only two items you should NEVER exclude from an inflation index. ‘

They are not excluded from CPI or PPI. Use those instead, if you like.

#16: you just coined the most appropriate misspelling I’ve seen in my several decades of looking for appropriate misspellings. “Oweners” indeed…

Really, LongOrShort might here launch a term that enters the lexicon. Jugs, JD, et al: figure out if you want a hyphen and then propagate this nugget.

This post may never be topped… Great work

Count me a homeowener.

Count me a homeowe-ner.

Homeoweners – as long as you have a fixed rate mortgage and are up to your eyeballs in debt you should thank Ben for inflating your debt away.

si si si

By your measure, i.e bars of gold, barrels of oil, ounces of copper, btu’s of natural gas, cubic feet of lumber, anything that has intrinsic value.

Hasn’t the world experienced a huge negative growth rate? I mean have the Arab countries have gone from being super rich to only rich? (Even though Arab countries are growing at 8% real)

I think your measure is wrong.

ba – you dont quite get it huh? underlying values of most goods havent changed that much – ie i’d still trade about the same number of onces of gold for a barrell of oil. not sure at all what you mean by negative growth.

One good rant deserves another. See-

http://nihoncassandra.blogspot.com/2007/09/open-letter-to-mr-mrs-america.html

Best article ever…

I hope you copied Chow.Daniel@bls.gov on that e-mail.

Great post. Your best ever. I linked you here.

Awe! Now come on, SOMEBODY had to do SOMETHING to continue the illusion that Goldman’s Global Beta is actually Alpha. They are, as Kramer keeps screeching, “My people”, after all. Bring on the smoke and mirrors, Benny! It’s inconceivable that Mark Carhart and his carry trade buddies should make less than 9 figures in any given year.

Out of curiosity, what is the all-time record for comments to an LoS post?

31, I think.

Make that 32.

I thought it was 33.

Wait, you’re right.

Oh shi

How come CNBC hasn’t picked this up? Given alot of the crap OTM (for one good example) covers, this should be prime time newd for Francis…

just realized my quasi-freudian slip (“newd” supposed to be “news”), w/e who’d mind a newd (or nude for that matter) Melissa Francis.

the supermarket aint selling stuff at the ‘Core’ rate. waaah :O(

So true, and so very criminal. Were collectively screwed except for those with political power.