March 31, 2006

The American Dream

Me: “In my dream, I was on Survivor.”

My GF: “In my dream, I killed 6 people and your firm covered it up.”

Me: “In my dream, I was on Survivor.”

My GF: “In my dream, I killed 6 people and your firm covered it up.”

Recently, Carl Icon, a noted corporate raider and greenmailer and Chairman of Liquid Icon Capital, LLC (“LIC”), announced his acquisition of a significant block of Long or Short Capital, LLC stock along with his intention to compel changes in management here at Long or Short.

Because we are happy in our cushy offices and enjoy our substantially over-inflated salaries and bonus plans ripe with inexorable options in a fictious stock, we have responded immediately to the threat to luxury with a multi-point takeover defense plan ready for instant implementation. This plan includes the following takeover defense measures:

We are highly confident that our superior management skills and expert spending ability will permit us to prevail over this vicious interloper whose only interest, and a shallow one at that, is superior returns for the paid-in shareholders of Long or Short.

Sincerely,

The Long or Short Management Team

It was only a few weeks ago, that we outlined that providers of pirate patches and clothing would benefit from the rising piratery tide. Now witness piratery on the catwalk:

It was only a few weeks ago, that we outlined that providers of pirate patches and clothing would benefit from the rising piratery tide. Now witness piratery on the catwalk:

Ever since pirates first sailed under the skull and crossbones, it has been associated with death. Now, this morbid symbol flies again in the upcoming fashion season…Should we be spending our hard-earned golden doubloons on the next must-have fashion items, or are there more important things in life?

Recommendation: We maintain that you should continue to spend your hard-earned golden doubloons on Tier 1 and Tier 2 piratery suppliers; their backlogs continue to grow granting significant revenue visibility and some of the cost pressures are abating. Also the changes in the weather patterns due to global warming play right into the piratery cross-sights as more of the Earth goes underwater, the tropical zones expand and hurricanes & natural disasters present chaos opportunities for pirateers..

I begin my descent to the 23rd floor. As I exit the elevator bay at my destination level, a colony of cubicles are laid out in front of me, perfectly aligned as if created by African honey bees. I scan the area and alight East, turning around a corner.

The monstrous IT guy remains motionless just ten feet away. Emotions give way to cognitive thought and I train my glare on him. Almost on cue, he begins his approach.

With blinding acceleration, he lurches onto me with a powerful “thud crackle”. He slams into my chest. The impact is incredibly powerful, knocking the wind out of me. His huge arms envelope my complete upper body and I can feel my non-iron shirt move as his beak grinds against it. The crackle and scratching of thousands of chitenous ring teeth against my suit is unmistakable. He withdraws back to 2 meter range and his huge bespectacled eyes begin to survey me for damage or weakness.

Behind him I can see dozens of man-sized IT fiends waiting to come at me but they don’t. Is it because he is so much larger? Is he the alpha dominant? He certainly has my full attention.

It is then that I notice his condition. His massive body is a map of pain and experiences. Scars cover his right side and most of his left arm is missing, possibly from being jigged by a rabid Hewlett-Packard or a lucky bite by a female he mated with. Due to his body marks, I call him ‘Scar’.

Long or Short Capital is dedicated to bringing you all the most recent developments in the buyout world? Accordingly, it would be remiss of us to fail to note the arrival of Carl Icon on the blogging scene via his new entity Liquid Icon Capital.

Hey, Carl — holla!

A macro trend that has concerned us greatly is the ability of the “family of four” unit to afford the modern American life. In previous generations, the FoF could afford any leisure they saw fit from sporting events to theaters to mega yachting; they could use the remainder of their moneys to run family farms which were crucial to soaking taxpayers for billlions in subsidies and ensuring that sugar was replaced with corn syrup in soft drinks.

Now the FoF unit is being priced out of the market, especially with respect to leisure. Consider that to attend a single baseball game at Fenway Park in premium seating would cost a FoF over $300; a sky box would be even less affordable. A trip to the movies would run an FoF almost $50, factoring an egregious amount of popcorn and a cadre of large ice pirates (note that the lack of the ability for any FoF to afford this leaves the $113mm domestic box office results of the Pacifier entirely unexplainable). Dinner at Nobu would cost a FoF nearly $300 assuming mom and dad wanted to tie one on. 1lb of commercial grade cocaine would cost $2,000 and a 140ft tri-deck mega yacht would run up a $28mm bill, completely out of reach for many FoF’s.

As you can see, just to attend a Red Sox game, go to the movies, eat dinner at Nobu, consume 1 lb of cocaine and buy a custom made Mega-Yacht would cost the avg FoF an astounding $28,002,650 per day. What kind of world are modern American children being ushered into, when obscene luxury is no longer a positive right?

Here is a list of affordable leisure activies for a FoF in the US:

Recommendation: Enjoy your excessive wealth and ignore the wahwah’s of the underclasses.

An Ode to Powerpoint:

While you were making your [PowerPoint] slides, we would be killing you.

-Russian officer commenting to a US offier on who would have won if we had ever actually fought WWIII in Western Europe.

Past Quotes Entirely Relevant to Investing

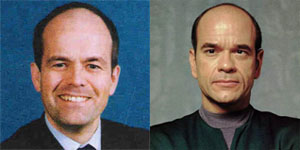

Continuing investigation by Long or Short Capital into the widening “Star Trek Imposter” scandal has revealed that Pitt-Fox, Kelton’s Head of Corporate Finance Mr. Mark Davison has also been embroiled in the controversy.

Prosecutors allege that Mr. Davison has been supplementing his income (and failing to report it) via similar Star Trek convention gambits as recently uncovered by Long and Short with respect to Enron bad-guy/Star Trek android David Delainey.

It appears Mr. Davison has been posing as Robert Picardo, Star Trek Voyager’s “Holo Doctor.” As a more secondary character, it appears Mr. Davison’s fraudulently obtained fees were substantially less than those commanded by Mr. Delainey.

A double life?

Recommendation: Short Mark Davison. Double Underweight Star Trek conferences. (Consider the “Double Star Trek Bear” fund). Accumulate the Wookie (again).

Julia Mezzanine Tranche is an analyst at Long and Short, the author of Going Private, as well as a member of the Non-Certified Advice Columnists of America, the International Society of Bad Advice Columnists and Chairwoman of the Prestigious European Association for Paperclip Entrepeneurs and Analysts (PEAPEA).

Note: some letters may be “enhanced” for self-glorification.

Dear Julia:

Recently, Long or Short Capital’s Johnny Debacle wrote an [interesting and dynamic piece on Phantom Bonds totally characteristic of the brilliant analysis that typifies Long or Short Capital]. He indicates:

If you have a 20 year plus horizon, then you probably want an allocation that is heavily weighted towards equity, say 90-100%. But you could supplement a 100% equity allocation with an incremental 20-30% of phantom bonds, without disrupting your asset allocation.

As I am 102 years old, my own horizon is somewhat shorter. Can you recommend some Phantom Bond allocations that might be better for my needs?

Signed,

I’m Dreadfully Hearing Impaired in Tiny Ithica, Texas.

Dear IDHITIT:

You are right to notice that Mr. Debacle’s allocation recommendations are not for you. Since you are likely to kick the bucket any day now I have two alternative recommendations for you:

Dear Julia:

I am an Associate in a large bulge bracket banking firm the logo of which I’m sure you would recognize. I don’t want to name it but it rhymes with “Virgin Snacks.”

Two of the Vice Presidents there ask me out constantly, make lude gestures and spank my bottom when I pass by their desks. One of them asked me to do something called “bobbing the pole under my desk while I’m on a conference call with Spitzer.” I’m not sure what that means exactly (Does it involve wine spritzers? Because, I prefer Smirnoff Ice.) but it sounds like a violation of firm policy. I am at a loss as to how to handle the situation.

Both of them are extremely well regarded in the firm and they bring huge segments of business into their department. They are also both extremely well socially connected in Manhattan. Their offices are a literal revolving door of meetings for a Who’s Who in Finance and Business roster during the afternoon.

I’m sure you can understand my distress at their simultaneous overtures. Obviously, how I deal with the matter could have deleterious effects on my career. Can you help me decide how to handle the situation? I don’t know which one to sleep with first.

Desperately,

Bulgebracket & Tax Girl

Dear B&T Girl

Finance, like life is dependent upon the effective allocation of resources. You need to prioritize and allocate accordingly. I recommend picking the one who lives in the American Gardens Building.

Have issues for Julia? Email your special situations, turnaround questions, advice on unwiding complex positions, insider tips or merger complications to: Dear Julia Drop Box

Read JD’s Lending No-No’s #1a and #1b. The focus today is on what can be gleaned from a lender presentation.

Examples:

Lending No-No #2b: Never loan to an industrial or manufacturing company, if the tchotchke they give you at a meeting immediately breaks in your hand.

Examples:

Examples:

In my unending search to uncover undervalued and badly named stocks I came across: “CAPEX SA” (CAPX.BA). CAPEX is an Argentinian electric utility serving the completely deserted but somehow still under-penetrated Patagonia region of South Ameria. We are initiating coverage of CAPEX with a SELL rating. CAPEX has a strong track record of raising and spending capital but that seems to be where the story ends.

A classic CAPEX investment:

CAPEX’s power plant in Neuquén Argentina; shown here along with the 10 people who actually live in Neuquén Argentina

If investors insist on putting money to work in the “companies named after financial statement line-items” universe, we recommend Revenue AG (which has a compelling top-line growth story) as well as Synergies Inc (which we view as a likely acquisition target).

We also reiterate our underweight rating of Diluted, Shares, & Co. which looks expensive as a result of perpetual equity offerings and excessive option issuance.

I haven’t seen such appropriate names since Michael Stonebreaker played football at Notre Dame.

Now if Tim Koogle, former CEO of Yahoo, would only work for Google.

Coming in the future: Inappropriately Named Executives

A loss never bothers me after I take it. I forget it overnight. But being wrong, not taking the loss, that is what does damage to the pocketbook and the soul.

-Jesse Livermore

Past Quotes Entirely Relevant to Investing

Long or Short Capital has initiated prophylactic coverage of “Boy-on-Boy” in conjunction with recently picking up “Girl-on-Girl.”

The Boy-on-Boy space is saturated by multiple market actors and opportunities for price discrimination are muddled by a highly fragmented marketplace. Increasing commoditization in the space limits opportunities for upside absent domination by a stronger alpha player. In addition, low or no barriers to entry mean that the stiff foreign competition (Dutch in particular) has deeply penetrated the nearly frictionless space from the bottom up.

Though recent interest in the market by regulators and Google (NASDAQ: GOOG -0.94/-0.27%) may restrict supply, unregulated foreign access to loose markets is too potent for significant supply disruptions.

Strong players, even those with multiple prior acquisitions in their portfolio, will have difficulty forming a cohesive long-term coupling with smaller market players therefore frustrating attempts to bag multiple targets and develop a dominant position behind other players.

Recommendation: Short Boy-on-Boy.