Gisele Bundchen is the richest, most powerful and the most currency-savvy supermodel in the world. Ben Bernanke is the current head of Fed and an afficianado on helicoptering. Below is a short excerpt from a debate between Gisele Bundchen and Ben Bernanke on the topic of the US economy, the weak dollar and the sub-prime loan crisis. Hosted by Jim Lehrer.

Gisele Bundchen is the richest, most powerful and the most currency-savvy supermodel in the world. Ben Bernanke is the current head of Fed and an afficianado on helicoptering. Below is a short excerpt from a debate between Gisele Bundchen and Ben Bernanke on the topic of the US economy, the weak dollar and the sub-prime loan crisis. Hosted by Jim Lehrer.

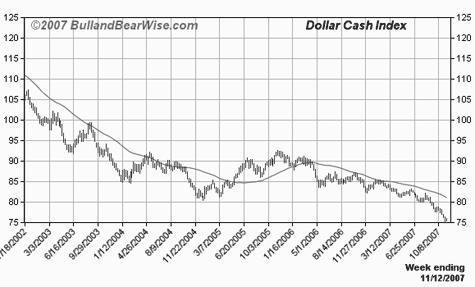

Jim Lehrer: First question for Gisele. Gisele you’ve recently announced you will no longer accept payment from modeling jobs in dollars. Can you talk about that decision?

Gisele: Well I was partying at Bugee in London recently and an American was trying to grease the bouncer to get in. He dropped one of the dollars he had in his hand on the ground and the bouncer looked at him and said. ‘Hey, pick up that trash’. I thought it was funny because the same guy had just thrown his cigarette butt on the ground and the bouncer didn’t seem to care about that. I got to thinking – are cigarette butts more valuable than dollar bills? So I changed my policy to protect my assets. Like gold and oil my hot assets have intrinsic value and are immune to inflation, I thought my contracts should reflect that.

J: Ben, your rebuttal?

B: I believe that the Federal Reserve’s success in reducing and stabilizing inflation and inflation expectations is a major reason for this improved economic performance.

J: Ok, good one Ben, but if inflation is under control why is everyone selling their dollars?

B: The Federal Reserve is committed to maintaining low and stable inflation and I’m very confident that we’ll be able to do that.

J: Genius. Gisele, back to you. Exactly how hot are?

G: Well that’s interesting because I’ve been trying to decide that myself. My old answer used to be “pretty f*cking hot”. But when I tried to have my assets insured the insurance company wanted a “more meaningful agency rating”. So I showed my assets to S&P and they rated them AAA which I felt was pretty good until I found out subprime loans have the same rating. Now I’m just a dumb model but come on I’m WAY hotter than a basket of subprime loans –

J: Great points. Ben, would you rather have a basket of subprime loans or have Gisele show you her assets?

B: Decisions of the Fed are made in conjunction with all the members of the board and I am not in a position to comment on future actions. But I will — YES.

J: It was an either or question.

B: I know. My answer remains YES.

Fin

Sweet Tea was cute, in the way that Krispy Kreme donuts were cute, a sugary Southern treat to Northern palettes. It’s great to have once, after that, eh, not so much. The existence of “Unsweet Tea” is a leading indicator that “Sweet Tea” is in fact, TOO sweet.

Sweet Tea was cute, in the way that Krispy Kreme donuts were cute, a sugary Southern treat to Northern palettes. It’s great to have once, after that, eh, not so much. The existence of “Unsweet Tea” is a leading indicator that “Sweet Tea” is in fact, TOO sweet.

Gisele Bundchen is the richest, most powerful and the most currency-savvy supermodel in the world. Ben Bernanke is the current head of Fed and an afficianado on helicoptering. Below is a short excerpt from a debate between Gisele Bundchen and Ben Bernanke on the topic of the US economy, the weak dollar and the sub-prime loan crisis. Hosted by Jim Lehrer.

Gisele Bundchen is the richest, most powerful and the most currency-savvy supermodel in the world. Ben Bernanke is the current head of Fed and an afficianado on helicoptering. Below is a short excerpt from a debate between Gisele Bundchen and Ben Bernanke on the topic of the US economy, the weak dollar and the sub-prime loan crisis. Hosted by Jim Lehrer.