Are Phantom Bonds Right for My Portfolio?

by Johnny DebacleA lot of questions have been coming in about so-called Phantom Bonds and where they fit in the asset allocation of a personal investment portfolio.

The answer is that it depends.

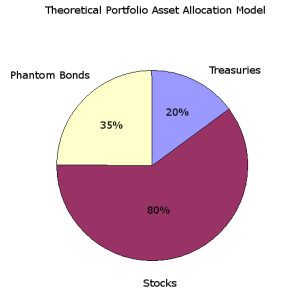

If you have a 20 year plus horizon, then you probably want an allocation that is heavily weighted towards equity, say 90-100%. But you could supplement a 100% equity allocation with an incremental 20-30% of phantom bonds, without disrupting your asset allocation. How is that possible? Well one of the unique features about phantom bonds is they don’t actually exist. So in addition to the existing equity level rate of return, phantom bonds would be adding both non-existant diversification AND non-existant fixed income payments.

Applying this to someone with a shorter investing horizon, for example a 45 year old CEO of a company who has 3-5yrs before he gets jailed for financial fraud, you could go 40% treasuries, 60% equity and 35% phantom bonds just to top up your returns a bit. You could also add leverage with the equity as collateral, but only if you could find the right bank to supply you the worst loan ever.

Recommendation: Phantom Bonds should become a cornerstone in 401k’s, but read up on them to make sure they are right for you.