Dear Valued Client:

Last week you received a letter from the head of Long or Short Capital Management, Mr Juggles. In this letter Mr. Juggles told you that although your money was invested wisely according to the prospectus, that money has subsequently disappeared. We wanted to write you to let you know that after further diligence this is 100% accurate. Your money is definitely, definitely gone, for sure.

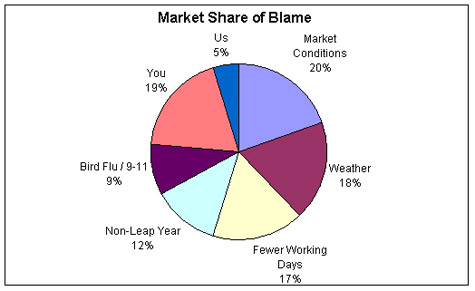

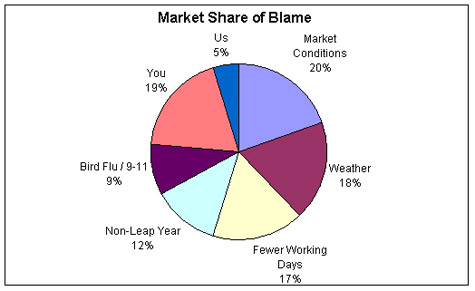

The feedback we received on the previous letter has revealed that you are unhappy that your money is gone but you were especially upset with our refusal to accept responsibility for your money being gone. Well first we would like to remind all of our valued clients that you shouldn’t point fingers. This is not just your fault, it’s everyone’s fault. Even ours, just to a much lesser degree than it is yours( especially important point for you to take away). We have completed a detailed and rigorous analysis of whose fault it is and thought it was important to share the results:

The chart depicts graphically the small size of our fault. After further study it was determined that all of our market share of the fault stems from one person: Mr. Juggles. As of this morning we have resigned him. Kaiser Edamame, our Germo-Japo restructuring expert and portfolio manager of our anti-union humor portfolio, will take-over for Mr. Juggles effective immediately.

We have also implemented several restructuring measures to ensure that when your money disappears in the future, it is less our fault than it was this time. Starting on August 30th, before we invest in low-yield, illiquid securities with high default risk we promise to “think-twice”. This represents a 100% increase in the amount of thinking we have done in the past. Also, in the case of our most risky investments, before we increase our exposure to them we will now “sleep on it,” something we have not done previously. We feel confident that these measures will significantly increase your returns and hence our fees over time.

Please contact me with any questions.

Subprimely,

Johnny Debacle

EVP Long or Short Capital Managment