Submitted by reader Matthias

Given the “consolidation” in the banking space that has started with IndyMac, the person that looks to become the heir of the U.S. retail banking industry, is FDIC Chairman and future Chief Holder of the Bag (CHB (disambiguation, this is not a reference to Dan Shaughnessy)), Sheila Bair. But who is Sheila Bair?

Per the FDIC web site, her background is in authoring children’s books, which undoubtedly will come in handy, as she explains to the depositing public the finer points of what exactly is NOT covered by FDIC insurance. The trouble is, the original story of “Rock, Brock and the Savings Shock” is just leading the Nation’s children down an ill-conceived path to risky savings, rather than opening their eyes to the prudent possibilities of borrowing.

From the book description on Amazon:

Rock and Brock may be twins, but they are as different as two twins can be. One day, their grandpa offers them a plan-for ten straight weeks on Saturday he will give them each one dollar for doing their chores. But there is a catch! Each dollar they save, he will match.

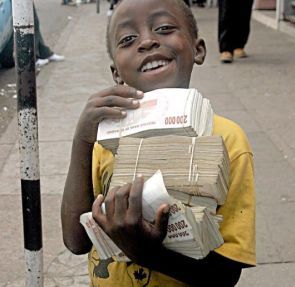

Rock is excited-there are all sorts of things he can buy for one dollar. So each week he spends his money on something different-a toy moose head, green hair goo, white peppermint wax fangs. But while Rock is spending his money, Brock is saving his. And each week when Rock gets just one dollar, Brock’s savings get matched. By summer’s end, Brock has five hundred and twelve dollars, while Rock has none. When Rock sees what his brother has saved, he realizes he has made a mistake. But Brock shows him that it is never too late to start saving.

Contrast this with the more recent thinking coming from CHB Bair:

The FDIC’s seizure of IndyMac has given Ms. Bair the ability to put her strong views into action. She has complained that lenders weren’t moving fast enough to help borrowers with troubled loans move into more affordable mortgages and avoid foreclosure.

Last October, she shocked mortgage servicers, investors and many in Washington when she pushed lenders to freeze introductory interest rates on certain high-cost loans to protect borrowers from unaffordable mortgage payments. As foreclosures snowballed, her plan attracted more attention. In December an industry coalition agreed to freeze interest rates for five years for certain borrowers who qualified.

Ms. Bair was pleased, but kept pushing. She argued for more, bigger government action. This spring, she proposed a $50 billion government-loan program that qualified borrowers could use to pay down a portion of their mortgages.

Recommendation: I think it is time to tell the real story of Rock and Brock. The one, where Brock puts his money into an FDIC insured savings account, while Rock asks his friend Kerimov to hook him up with some later-untraceable source of leverage, investing the proceeds in Russian oil assets. At the end of 10 weeks, Brock’s savings bank is kaput, wiping out most of his savings. Over the same period, Rock’s oil assets have doubled, which leaves him with enough cash to purchase the operating assets of Rock’s S&L, after negotiating a free put from the Fed. And a Ferrari Enzo.

Topher Cox, head of the SEC and also a Jedi knight, has issued an order aimed at crushing the short-sellers and SITH lords who are trying to destroy the GSEs and some of the major investment banks. That order is the requirement that a trader must

Topher Cox, head of the SEC and also a Jedi knight, has issued an order aimed at crushing the short-sellers and SITH lords who are trying to destroy the GSEs and some of the major investment banks. That order is the requirement that a trader must  In my family, it has been a masculine tradition to keep logs of economic thought and financial analysis since the days of Ancient Rome. I will from time to time share with you relevant passages from these Legacy records.

In my family, it has been a masculine tradition to keep logs of economic thought and financial analysis since the days of Ancient Rome. I will from time to time share with you relevant passages from these Legacy records. Do you ever have one of those days? When you feel like you might just default at any second? It could be spurred on by a liquidity crisis, like Ford took away your factoring, or has contractual price downs that are killing your margins and is ordering less volume to boot, and your revolver is maxed out, and good luck raising any more money in this market. Suffice to say, you’re regretting your decision to be a consolidator in the auto supplier space. Or it could be a liquidity crisis where you had one too many jaeger bombs and the smell of your toilet indicates you may have also had too much tequila, but you have no memory of having ANY tequila. Either way, you could default at any second and you don’t like where things are headed.

Do you ever have one of those days? When you feel like you might just default at any second? It could be spurred on by a liquidity crisis, like Ford took away your factoring, or has contractual price downs that are killing your margins and is ordering less volume to boot, and your revolver is maxed out, and good luck raising any more money in this market. Suffice to say, you’re regretting your decision to be a consolidator in the auto supplier space. Or it could be a liquidity crisis where you had one too many jaeger bombs and the smell of your toilet indicates you may have also had too much tequila, but you have no memory of having ANY tequila. Either way, you could default at any second and you don’t like where things are headed.