February 11, 2009

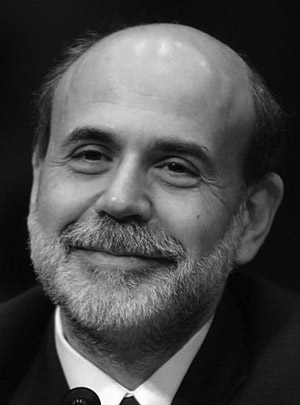

The Man Swimming Next to Me Looks Like Ben Bernanke

I do laps at my gym’s pool on a regular basis. It’s tony, the facilities beautiful. The water is not too chlorinated, just enough to know that when I pee in that pool I won’t feel guilty about it. Today at my natatorium there is a difference, a difference that interrupts my epic meditation on intangibility and not-drowning. In the lane next to me there swims a man who looks exactly like Ben Bernanke. He could be his doppelganger.

I stroke and see him wearing his balded dome like a mongoloid’s swimcap. Fringes of hair flopp as his head breaches the water. His beard is cheerfully limp, soffy rather than grizzled. His lips plump but distorted, an aubergine deflated balloon encircling his mouth, gasping for breath, trying not to swallow. The whole effect is that of a walrus awkwardly pushing its limbs in an attempt to survive these unfriendly waters in his ill-fitting man suit.

This non-Ben Bernanke is doing a modified backstroke, flailing his arms backs while doing some sort of starbust kick or inverted frog kick. I wonder if he understands that that is no way to stay afloat.

I begin to daydream as I stroke past. Maybe next pass I should dolphin kick myself under the divider, under his manatee-like body, wrap his throat with my arms and pull him down into the deep. I’d torque his body in a twisting motion to perform a human spiral. My superior lungs ensuring my survival. I take another breath.

He is doing a leisurely sidestroke now. I switch to butterfly intervals and once again slip into fantasy. The back of his head is a perfect target, one wayward stroke and my fist would land an incapacitating donkey punch. Or maybe I find a way to take a ninety degree left turn and drop two devastating elbows on his back, leaving him unable to be bailed out.

Is this him? Could it be him? Is this a man deep in thought about interest rates, about replacing the invisible hand with his clammy visible palms, about the need for an even bigger TARP, a mega-TARP. It’s difficult to tell. He kicks awkwardly, he inspires no confidence in his own solvency, and he looks mildly retarded. But it makes no sense, he should not be in NY, he should be in Washington, doing…something. Shouldn’t he?

Regaining my focus, I pour myself into the fluidity of my own motions.

But I can’t escape it. Why do I lust to bring ruin to this man? He looks kind. He is not responsible for twenty years of reckless leverage. He did not give us these fake free markets, where the only regulation allowed was the most distorting or feckless. He did not bring us here. But that face, that singular face just staring at you, so dumbly, as everything falls down around him. I want to punch it.

That face.

I’m just glad it wasn’t Geithner.