Piratery: A Warren Buffett of Booty

by Julia Mezzanine TrancheIn connection with recent recommendations on piracy, Long or Short Capital’s managers have been closely tracking developments in the privateer market. So too has one famous Nebraskan investing guru.

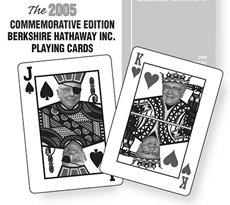

We have uncovered renewed interest by Berkshire Hathaway in piratery and, in fact, the adoption of piracy directly by Berkshire’s Warren Buffett, and therefore we are boosting our recommendation.

Recommendation: The piratery theme is approaching the mania stage, and as such, we think that it may be time to adjust your investments from direct piratery to investing in the enablers of piratery. Note that value investors like Berkshire Hathaway (BRK.B) are noting this as well. As we recommended in our Long Mudpies analysis, in sectors with a “gold rush” mentality, it’s the producers of the “picks and axes” that benefit the most surely. One way to play this would be to pick up some long dated call options on both tier 1 and tier 2 eye-patch manufacturers; currently, options on the brewers of the finest rums in the seven seas are all trading at premiums that make them less attractive, but still delicious.

Great Post! What are your recommendations on the cutlass manufacturers? Would you play this on the blade makers, or go for the sword rental outfits?

Also, any thought on the impact of high prices for steel on the manufacturers, since the price of this raw material is one of their largest costs?

I’ll fill in for Julio.

Cutlass Manufacturers were overbought in Q4, the market got ahead of itself and we see it deflating a bit. Plus with the recent spat of litigation against pharmaceutical companies, we think it’s only a matter of time until the tort tsnumai rolls over the Tier 1 Piratery Suppliers, with suits concerning death, rape, pillage, and excessive rum usage, all of which have been proven to be deleterious on users health or legal status.

Steel, and the rising price of all commodities, has been a constant issue for all Tier 1 Piratery suppliers, but it’s been a net positive. They are not only able to pass on any rises in COGS but they can generally even double-down and source their feedstock needs through thievery and sell surpluses for a 95% margin on the open market.