Sorry Guys, Friday Didn’t Happen

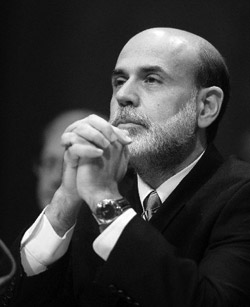

by Johnny DebacleBen Bernanke’s speechwriter’s first draft for a Monday morning pre-market open speech.

Good morning. There has been quite some concern about the general economic outlook of America. There also has been quite some concern about the existence of inflation. We will ignore the latter for the time being, at least until Zimbabwenomics is better understood and appreciated by the public. Let’s focus on the general economic outlook, and by that, I mean the stock market.

The end of last week was not pretty and I am surprised you didn’t hear my speech on Wednesday where I hinted that, yeah, some rates are gonna be cut and I will be bathing America in cheap money. Those of you who disregarded my comments should know something that is really going to make you feel foolish, but hopefully still willing to revert to some of that good old fashioned exuberance that helps keep these markets afloat.

Friday, February 29th, doesn’t count. That’s right. Simply didn’t happen. It was the leap day of a leap year, an anomaly, and we have the ability at the Fed to strike an anomalous day from existing. We plan to utilize this power that we have at our discretion, and via open market actions, remove the existence of February 29th from the record books.

If we let Friday exist, it will distort comparisons with prior years and also it meant that markets went down a lot. And to that I say, not on my watch, sir, not on my watch. So expect all your portfolios and investments to be reset to their close of business Thursday values very soon. And remember, who loves you? I do. Thank you.

Related Reseach:- The Economy in a Picture

- The New Fed Model

- The Llama of Lame

- Who wants a drink from the Interest Rate Hose?

- Bernanke in Pictures

- The Ring of Greenspan

Yeah it was crazy. There I was trading the markets all day and we get to the end only to find out it’s gonna be a do-over. Why didn’t they just give us the day off if it wasn’t going to count?

By the way, I’ve become a big fan of the Republican party and their market based solutions. I figure the SPX returns over the last 7 years tells us all we need to know about how well our government is running the show.

I smell another emergency 75 bps rate cut pre-market on Monday. Before the dollar knows what hit it.

gimme 200 bps!!! Thanks Ben, you made currecy hedging of USD-bonds affordable!!!

I know, I know… it’s probably me. But I am finding it harder and harder to find anything funny about Uncle Ben. You know?

In general or wrt to our content?

that’s a great picture

Mr. Juggles – in general.

Your satire is agreeably good and well presented for sure. Though, like the government at large, Ben has surpassed the all too common stature of WTHIHD (What The Hell Is He Doing) to a loathed WTFTFFA (What The F***, This F*** Face Again?). Because of this unfortunate change, Ben can no longer be poked fun at like a mere annoying purple dinosaur. Oh no. Ben is clearly beyond that. Ben is now in the realm of “I need to use that stimulus package and rate cut to buy a WASR-10 and a bucket of 7.62’s.â€

Being what I may (WTF Jr.), I have a side of levity. Maybe this could be viewed as an opportunity to evaluate how McDonald’s has successfully marketed crappy hamburgers for decades and in turn, apply this winning method of underachievement to continue humiliating Uncle Ben for another year… or two.

McDonalds produces delicious food which makes people lust for their delicious food. Seems like you want us to produce delicious food; we can and will oblige that wish.