April 26, 2009

Quotes Entirely Relevant to Investing 04-26-2009

Life is tough ….. It’s even tougher if you’re stupid.

– John Wayne (HT SCH)

Life is tough ….. It’s even tougher if you’re stupid.

– John Wayne (HT SCH)

We refused to touch credit default swaps. It would be like buying insurance on the Titanic from someone on the Titanic.

-Nassim Taleb (HT CP)

Morons. They are everywhere. But brilliance, true brilliance, should eschew their limiting grasp. As we think important both the recognizing of brilliance and the eschewing of moronism, we are establishing The Andy Beal Award For Eschewing Moronism. Who is Andy Beal and why is he being so honored? He is someone who eschewed moronism, you moron. He sailed his Beal Bank through the choppy loan waters like an extraordinary seaman, navigating it to the point where it has capital to buy loan assets when everyone else is forced selling.

Beal stopped making commercial loans. “If I see another office condo in Las Vegas or Phoenix, I’m going to throw up,” he said at the time. He started selling, too. At a price of 115 cents on the dollar he unloaded a $75 million pool of loans that had been extended to Kmart, exercise chain 24 Hour Fitness and Regal Cinemas. That translated into a yield for the buyer of a mere 1.35 percentage points over Treasuries. “They were great loans at 85 cents,” says Beal, referring to the price he had paid for them years earlier. “They’re stupid at 115.”

He waited patiently for his time to come.

Beal started coming to work at 10:30 and leaving at 2:30. He challenged colleagues to backgammon games and took hour-long lunches, complaining of being “bored stiff.”

He’s not taking help from the government because their programs are scams on the public, designed to only benefit those who acted most irresponsibly during the boom times.

He’s getting scant help from the government. The Troubled Asset Relief Program does not accommodate a guy like Beal because the maximum amount available is 3% of 2008 assets. Had Beal leveraged up his capital to $25 billion and made toxic loans in the last few years, he would now qualify for $750 million. As things stand he can get only $150 million, hardly worth the trouble given the strings attached.

Finally, he berates the government publicly for its duplicity.

After New York state’s highest court ruled against him in a contract dispute in 2007, Beal took out a full-page ad in The Wall Street Journal asking: “When is a contract NOT enforceable according to its clear terms? When it is in the state of New York.”

Recommendation: Although only a baby compared to its predecessor, The Patrick Byrne Award for Operational Focus and Excellence, The Andy Beal Award For Eschewing Moronism is already incrementally more prestigious.

Those who trust to chance must abide by the results of chance.

-Calvin Coolidge

What Mr Greenspan and Mr Bernanke have achieved is historically quite unique. They have managed to create a bubble in everything, everywhere in the world: in real estate, equities, commodities, art, worthless collectibles; even bond prices continued to rise as interest rates fell due to the loose monetary policy. Since 2007 and 2008 everything has collapsed. But government bond prices continue to rise, and went ballistic between November 2008 and December 2008, when 10- and 30-year Treasury yields collapsed. So my view would be that this was the last bubble they managed to inflate. From here on, the government bond market will fall. In other words, the trend will be for interest rates to actually go up.

-Marc Faber

When Lenin was little, all the birds in the forest were singing

“Man, this is it!”

But now that he’s older, all the sailors in the heaven are singin

“Abandon Ship”…

Daddy, Daddy, please spare the world from the government

Daddy, Daddy, please spare my soul from my own judgment

Daddy, Daddy, please send me a heart that isn’t made of cement

’cause the money’s all been spent

the money’s all been spent

the money’s all been spent

the money’s all been spent

-Arcade Fire in the song “Lenin”

This is a sponsored post

Times are tough. If you walk out onto Wall Street these days, it looks worse out there than Oklahoma did during the Depression. Things have gotten so bad that Steinbeck plans to write The Rapes of Math, a sequel to his most famous novel, this time based on the experiences of those in finance. He plans to write this from his grave, after Alvarez & Marsal recapitalize him, restructure his operations and generally work him out. Some people call them vultures; I like to think of them as mad scientists who bill $600 an hour or $200,000 per month to reanimate corpses.

At Long or Short Capital, we have been proactive in our response to the Great Regression. We embezzled as much money as we could before the invisible hand hit the fan, so to speak. Then we stopped our dividend to ensure that we could build an adequate capital cushion to weather this storm. More recently, we have retained counsel to make sure we had adequate cash flowing out of our operation and to cover us from litigation from irate subscriberholders. Now, we bring you this sell-out saturday about this wonderful site called Wall Street Survivor because we really really need the money.

You may ask — how does this site work? Why does it exist? Specifically, how does it help someone survive Wall Street?

I would answer: I don’t know, I don’t know, and by not having you invest fantasy money into fake stocks, respectively. In fact, if you were to have invested your portfolio solely in a portfolio at Wall Street Survivor, you would have outperformed every single major index in 2008 and YTD. There has not been a better time to invest in a fantasy portfolio than the last 18 months and I say that despite the fact I am being paid to write this. I also say it because I am being paid to write this. But Wall Street Survivor has never lost me a dollar, which is something you can build on. Also, as indicated in the post title, I have not been poisoned by their site which is to their credit as well.

It has become apparent to us that in this period of economic catastrophe that there will be an increase in rent-seeking generally, and legal wrangling, specifically. To ensure that we are adequately protected from/by the legal mafia, we have retained our own made esquire, Pleb.

Based on his first memo, two things are clear to us:

Recommendation: Legal counsel is a market which is clearly not Mugabe Optimal. We think the former lawyers who populate congress should do the right thing and make the supply more affordable for the demand.

That’s bad business. How long do you think I’d stay in operation if every time I pulled a job, it cost me money? If he’d just pay me what he’s spending to make me stop robbin’ him, I’d stop robbin’ him.

-Butch Cassidy (HT Austin)

DON’T PANIC.

-The Hitchhiker’s Guide to the Galaxy

What goes down will come up — unless destructive policies interfere with the sources of potential recovery.

–WSJ Opinion Journal (HT SCH)

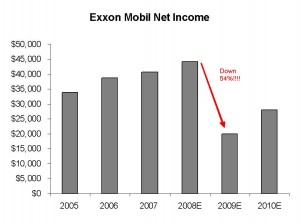

Just asking but will Exxon Mobil (NYSE: XOM) receive windloss (windrise?) tax rebates? It’s absurd that any company should be allowed to lose so drastically simply because they have exposure to commodities. Oil is not the property of any company, it is our shared inheritance from Mother Gaia. Exxon is simply responsible for taking care of this precious resource and getting it into both our tank (it handles like a dream off-road, has room for my family of four, has 6 cupholders and 2 dozen 120mm anti-tank round holders) and our tanks. They and their shareholders shouldn’t be forced to bear the brunt of such a terrible decline in prices!

I’m just asking….

If I had six hours to chop down a tree, I’d spend the first four hours sharpening the axe.

-Abraham Lincoln

Even discounting for the impact of global recession, the most populous state’s ills are unique and self-inflicted — and avoidable. In the last three decades, California expanded the public sector and regulation to Europe-like dimensions. Schools, state employees, health care, even dog kennels, benefited from largesse in flush times. Government workers got 16 official holidays, everyone else six. The state dabbled with universal health care and adopted strict environmental standards. In short, California went where our new president and Nancy Pelosi of San Francisco want America to go.

–How California Became France, WSJ

California is the canary in the US coal mine and it’s likely too late for Johnny Debacle’s Debacle Plan for California. Instead of isolating abject failure by pushing it into the ocean, the intention now seems to be to replicate many epic fails that plague California and apply them to the rest of the country. What are the differences between the state of CA and the US? First, the US is a couple years behind the west coast’s expansion into liberal fantasy. Second, the US can borrow to finance its deficits while CA is tapped out and on the staring down at a true fiscal crisis that awaits them below.

Don’t fret, Dear Taxpayer. The US will catch up with California soon enough. And then, when inflation has picked up and our growth rate is structurally slower due to the expansion of government as a % of GDP, the increase in regulations on all businesses, and higher tax rates on individuals and corporations, our foreign lenders will finally pull the plug. We will look a lot like California does now, or more aptly, a lot like like a pre-op France.

There is a argent doublure here. France is a pretty good place to live, with only a few caveats. That you are wealthy, that you have connections throughout the ruling class, and most importantly, that you are not an immigrant. Oh and make sure you are white too, just so there’s no confusion. To be clear, there is no upwards mobility but that’s great when you are already on top! Furthermore, the French have amazing cheese, put on exquisite union strikes and were responsible for Man on Wire, one of the best documentaries I have ever seen.

Recommendation: Quickly accumulate a large fortune, if you haven’t already. Punitive tax rates, prevalence of government jobs, and a stagnant business climate will prevent upward mobility so it’s critical to start on top. Second, acquire a taste for fine cheeses and wine. Third, begin practicing your strike routine; this will be critical to maintaining your benefits. Fourth, be cautious that you are not slowly being boiled without realizing it.