Dear Valued Client:

As you may know, the investment process has a normal course. Generally accepted investing practices follows that you, the investor, give us, the manager, money. As manager we take that money and buy something with it. This something generates profits and at the end of the year, we pay ourselves some dollar percentage of those assets, as well as some percentage of the generated profits. Everyone profits which is a good thing.

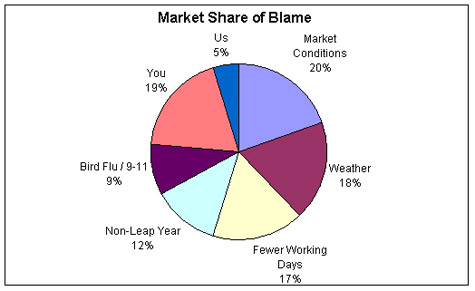

Unfortunately, the money you gave us did not follow this normal course. Per usual, we “invested” your money in tranches of CDOs comprised solely of loans to people who specifically would never be able to pay down their mortgage. Their inability to pay was the very thing that made these such great loans and allowed us to demonstrate to you a profitable two year record of performance. This could have continued but your money decided to disappear.

As far as we can tell, there is no current record that points to existence of your money. It’s no longer part of our assets under management. Look, it’s up to you how you raise your money and I don’t want to get into a nature vs nurture sidebar with you, our valued client. But don’t you think that maybe you should have imbued your money with more of a sense of sticktuitiveness? I mean, it literally seems to have vanished at the worst possible time, what with the depressed prices and attractive yields which now litter our market. This is when we could be printing profits for you (if only your money hadn’t disappeared).

I guess, for us, we’re disappointed in you. Your role is to let us take your money, assume none of the risk and allow us to give you some of the return. Don’t you see how this relationship breaks down if you allow your money to disappear? We’re not angry with you, just disappointed. It’s your loss, as we still earned our management fee, it just seems like a waste for you.

I have enormous confidence in Long or Short Capital management and the ability of our talented professionals to bring you the highest quality products and services now and in the future as they have in the past. You can count on us to deliver…if you don’t let your money vanish.

Sincerely,

Mister Juggles

Related: PDF of Bear Stearns Asset Management Letter via Dealbreaker.