Quotes Entirely Relevant to Investing 09-23-07

by Mr JugglesThe true measure of a career is to be able to be content, even proud, that you succeeded through your own endeavors without leaving a trail of casualties in your wake.

Alan Greenspan

The true measure of a career is to be able to be content, even proud, that you succeeded through your own endeavors without leaving a trail of casualties in your wake.

Alan Greenspan

To: The Fed

From: Long or Short Capital

Re: You suck

Dear the Fed,

You suck. You don’t have a backbone and as a result you are slowly and very surely making our country and our currency irrelevant. Usually the masses rebel and bring down great empires but luckily for us democracy fixed that problem. Unfortunately, democracy can’t fix how lame and fickle you are and so you will be our ruin.

A few things to tell you:

1) Inflation isn’t 2% like your pathetic CPI ex-Food & Energy says it is.

First of all, as far as I can tell food and energy are the only two items you should NEVER exclude from an inflation index. Tell your wife and kids they can have everything in the consumer basket except food and energy and you will quickly see that they are actually the two MOST important and indispensable factors in the CPI. You can find substitutes for, or go without, everything in the basket EXCEPT those two.

Secondly, stop using “Seasonally Adjusted Intervention Analysis” it’s as sketchy as the Seldom-Accepted-Accounting-Principles (SAAP) we use to cook the books here at LoS. I mean writing a computer program to automatically remove any items in the basket which deviate meaningfully from the previous year? Isn’t the point of the data to SHOW the change versus the previous year not hide it? Oh, I found the list of items that you’ve adjusted for and it’s embarrassing.

The majority of adjustments remove price increases with much less frequent adjustments for price declines. You’ve basically left dairy products out of the index for the last 5 years citing outrageous one-offs like “a generally tight cheese market” as justification for this. And as if reporting a separate ex-energy index wasn’t enough you’ve statistically intervened to remove the effect of higher energy prices even in the index that’s supposed to INCLUDE energy. In one outrageous case you removed the effect of fuel oil for three months in March 03 and the reason you cited for the “abnormal” move was the “end of winter,” yeah I was surprised as sh-t when winter ended in Spring 03, it was wild! For a real measure go back to the old method, you’ll see inflation is at least double what you’re reporting.

2) Grow a spine you slimy invertebrate

The market has a memory. Over the past 15 years you trained us to believe that no matter how much risk we take, and how much we lever that risk, if anything really scary comes down the pike then you will bail us out. Now we all run around like reckless, spoiled 16 year olds bidding up the price of anything we can get our hands on and not worrying about consequences because daddy (Greenspan) and mommy (Bernanke – that’s right you’re spineless AND a girl) will get us out of any trouble we get in. Well you’re only making the problem worse and we aren’t learning anything so we’ll continue taking stupid leveraged bets creating bubble after bubble so you can tip-toe around trying not to pop any of them.

3) You’re lying to yourself if you think we still have real GDP growth in this country.

I challenge you to find one measure of wealth OTHER THAN THE DOLLAR which shows the US economy as worth more now than in 2001. If I wanted to buy our country it would cost me 30% fewer euros today than it did in 2001, it would cost me less bars of gold, less barrels of oil, less ounces of copper, less btu’s of natural gas, less cubic feet of lumber, less of almost anything that has intrinsic value. Yet you keep reporting GDP growth, why? Because your quick fix is to effectively print more money so that in dollar units everything is getting more “valuable”. But guess what, to the 95% of the world that doesn’t use dollars the true value of the US economy has been shrinking, rapidly.

It’s like a company doing a 5 for 4 reverse stock split every year and claiming to have 20% eps growth, you haven’t changed the earnings just the units those earnings are measured in. The rest of the world is telling you our country is worth less by massively selling our currency and you still naively think we’re growing value – I feel like I’m at a gathering of the flat earth society or in Zimbabwenomics 101.

This will come back to bite you but not nearly as much as it bites us. The cheaper the dollar gets the more expensive all our imports get, inflation will rise faster than you can statistically manipulate it and when that happens expected inflation goes through the roof (which as you yourself have pointed out many times is by far the most serious threat to economic existence). Then the only way out will be interest rate increases as swift and severe as all the cuts have been. All the bubbles will pop at once and then we’re really in for it. Maybe it’s 10 years away but there’s a toll collector at the end of every free ride.

When will you learn that recession is ok? It’s actually healthy, it’s the cycle, it’s how things have worked for a thousand years. Trying to prevent every small recession is going to end in one huge recession (ie. depression) and no one will trust you anymore which is a much bigger problem. No economy in history has ever been able to successfully inflate its way to health, this won’t be any different.

Benny, I know you had to trade in your hypothalamus and spine to be fed chairman and now you biologically over-react to everything and are incapable of standing up straight when confronted by bully-morons like Kramer. But I’m hoping you at least still have your brain. Before you had this job all your published research showed that central banks should strictly target inflation and should be ignorant of asset prices. You had good reasons for this conclusion, don’t forget them.

Subprimely,

Long or Short Capital Management

Mr. Bernanke was afraid of ratecuts

He packed his briefcase and smacked his wife’s butt

He waited his whole damn life to make that cut

And as the economy crashed down he thought

“Well isn’t this nice…”

And isn’t it ironic… don’t you think

It’s like pain on what would’ve been bonus day

It’s a free ride when Greenspan never paid

It’s the good advice that you just didn’t take

Who would’ve thought… it figures

Dear Investors,

Following our analyst report on E*Trade yesterday, the stock traded down 7% (and probably still has room to go). Our report uncoveerd the hidden underbelly of E*Trade. LoS provides timely, relevant and actionable information which can, has and will move markets. We aren’t your ordinary sell-side or independent investment advisor, which is precisely why we provide value.

You’re Welcome,

Long or Short Capital Management

Actual picture outside of a Northern Rock (LSE: NRK) location somewhere in Britain yesterday:

Recommendation: Long British panic, Long runs (especially on banks).

E*Trade (NASDAQ:ETFC) is a discount broker known for delivering low cost and mostly terrible execution to the investing plebes. How do they achieve such low costs? It’s never been clear how they achieve such low prices, aside from under-staffing, offering terrible customer service, and failing to function when you need them most. But the key to their low cost ways has been revealed. On their front page, they are frequently displaying this image:

From this, we can discern their trading platform was created by forming an LCD computer monitor to a 50’s drag racing engine. The result is a foul chimera that spews a trail of green flames as it ensures its customers get the weakest price possible.

Recommendation: Aside from the possible environmental ramifications of green flames (well known to be associated with the guano fuel source), we have to question if this is the best way to achieve execution for their customers. Our estimates are that the actual engine is almost 84.8% useless, and given the unlikelihood that a heat sensitive component like a CPU could be housed in that engine, we question whether that machine is capable of any computing whatsoever. In all likelihood, the LCD monitor is just displaying random gibberish that looks “stock brokery”. Short E*Trade; we think there is a catalyst for a sharp diminution in E*Trade’s valuation as more evidence of their shaky trading platform comes to light.

If there are no stupid questions, then what kind of questions do stupid people ask? Do they get smart just in time to ask questions?

Scott Adams

Read JD’s Lending No-No’s #1a and #1b and JD’s Lending No-No’s #3 through #4. The focus today is on what can be gleaned from people who have financed Norman Hsu.

Lending No-No #4: Do not lend for a tenor of less than 6 months, getting a 40% return over that time frame, unless you fully expect that one of three outcomes will or has occurred: 1) you lose all your money 2) you are killed or 3) you are a killer.

Example:

Normas Hsu suckered people into providing him short term “bridge loans” that would return 40% in less than 6 months. The mostly nonsensical rationale for the bridge loans, was that they were needed for “for seasonal high-ticket, high-quality retail goods made in China for exclusive brand names.” These firms couldn’t get better financing than an 80%+ annualized rate? I’m sure the Triads would have gone lower. Amazingly, real people with real money poured millions into financing these bridge loans, apparently doing no due diligence and trusting a man with a warrant for grand theft outstanding on his head.

Lending No-No #5: Never neglect to perform due diligence, if you plan on writing a big check for too good to be true returns.

Example:

Following on the above situation, maybe if you are an investment firm, providing sketchy bridge loans to Chinese intermediaries, maybe, just maybe it makes sense to do a background check on that man. You know, see if he has, I don’t, a criminal record of scamming people>

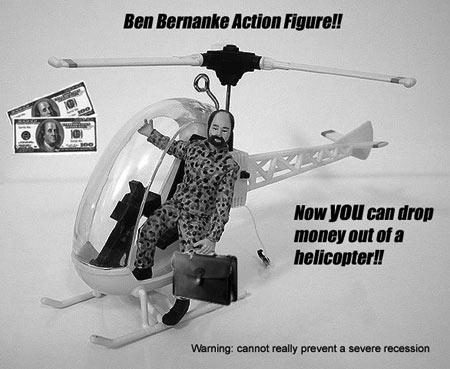

Long or Short has been polling some industry contacts on the impending decision facing Ben Bernanke and the Fed as to whether they will make their move, or will make their announcement to back up their stealth move which they have already done, or will do whatever it is they do next week. We share with you the results.

Long or Short has been polling some industry contacts on the impending decision facing Ben Bernanke and the Fed as to whether they will make their move, or will make their announcement to back up their stealth move which they have already done, or will do whatever it is they do next week. We share with you the results.

Robert Sinche, currency strategist at Bank of America: “[The job report] sets the backdrop for the Fed to ease. The markets have really been torn in recent days by some signs that some of the data in August was holding up reasonably well. This data certainly sets a different tone — particularly things like manufacturing, where the export sector had been holding up pretty well.” (Source: WSJ)

Ajay Rajadhyaksha, fixed income strategist at Barclays: “I think the market’s going to be disappointed with what Fed does in September.” (Expects 25bps)

Neptune (the planet not the god): (Note: it takes a satellite about 10 years to reach Neptune, luckily we knew all this would happen almost 10 years ago and sent the USS LoS to do the interview at that time, it just got back) “Well, fall-out from the sub-prime crisis has reached the outer limits of the solar system too. I myself am deeply underwater on 4 condos in Phoenix and I don’t even want to talk about Io. Given that I’m a desolate and empty planet you would have thought it would be hard to get a loan for these speculative properties but I found it quite easy. Anyway I think it’s important for the credibility of the fed that all these foolish dummy bankers and investors learn their lesson, if the fed bails them out, all of them will just go back to buying risky assets assuming that if something goes wrong the fed will fix it. Unfortunately for earth I don’t think Bernanke will stick to his guns. Ok, have to go back to being freezing cold and lonely now, bye.”

A common dragon on the street: *FIRE!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!*

Poseidon (the god not the movie): “If, as I have, you, mortal, had seen the ways in which the sub-oceanic mortgage crisis has ravaged the coral reefs as if Ares himself had taken his great axe to them, or the extent of the layoffs that have taken place at the shell exchanges, then you too, mortal, would see the economic imperative of reducing the above-sea-level Fed Funds rate by at least 75 points of basis.”

John Cusack: “I think they will do something. Ok, well, I’m hoping they do something. Note to the kids, never buy 75 spec houses in Las Vegas and Florida, even if you are a ‘movie star.'”

Sauron: “My prediction is that [Bernanke] will look towards making one [cut], one [cut] to rule them all. This [rate cut] would cover all of Middle Earth in [a low interest rate]. This [rate cut] would allow the orcs to move across the land, and Mordor to dominate the realm of men.”

Postmodernism: “The rate cut will be 50bps, on the nose.”

Ballers vs mini-ballers is a class clash that reverberates through today. It is especially appropriate as markets collapse, and a global financial crisis begins that will destroy almost all investors wealth (we will have more on this in a December report), leading to unemployment and the derichment of scores of BSDs. ONN did a video report highlighting some of these issues, and is a must watch for ballers and mini-ballers alike.

Recommendation: Don’t judge a rich person until you have walked a month in their repossessed hovercraft. Long The Wealthy, short poor people.

It never was my thinking that made the big money for me. It was always my sitting. Got that? My sitting tight!

Edwin Lefevre

Building on the phenomenal success of the European Chunnel, government planners are coming up with more ways to inventively throw citizens’ money at a hole in the earth. In addition to the Turkish “chunnel” known as Marmamray, we have this development:

Building on the phenomenal success of the European Chunnel, government planners are coming up with more ways to inventively throw citizens’ money at a hole in the earth. In addition to the Turkish “chunnel” known as Marmamray, we have this development:

In recent months [the] governments of Morocco and Spain have taken significant steps to move forward with plans to bore a railroad under the muddy bottom of the Strait of Gibraltar. If built, the project would rank among the world’s most ambitious and complex civil engineering feats, alongside the Panama Canal and the Channel Tunnel between Britain and France.

Consider some of the benefits of the proposed Spain-Morocco chunnel :

Recommendation: Long planes, Short chunnels, especially those linking Turkey to anything but mashed potatoes and gravy.

God.

You think you are so much WORSE than I am.

Just because I make all this money and have more flat screen displays on my desk than you have months in this country, you have this righteous feeling of inferiority, that you somehow get to stand below me. Well, I’m onto it and quite sick of it. El juego is up my dear and I will now fight back.

I have taken to deliberately throwing actual trash into the recycling bin below my desk. Non-confidential recycleables go into the shredding bin. Oh yes, your lovely order is completely messed up. You were so smug in your inferiority, slicing me with your covetous glances as you strolled in, and I strolled out. Now I strike down those furtive glares with my knowing insolence.

You may have noticed sometimes I put papers directly in between all three bins. This is no mistake. I know the panic it sets off in your core.

“Which bin¿” you whisper to yourself, very spanishly. That is a good question. Which bin, indeed.

These heroes of finance are like beads on a string; when one slips off, all the rest follow.

Henrik Ibsen