Long or Short Capital’s fiscal 4th quarter ended on 7/31/06, and the company reported their results for both Q4’06 and FY’06 in a press release on their site:

Mister Juggles: “Long or Short had 4th quarter performance in line with management’s expectations for the slower summer months. Sequential same store traffic of 21%. This is the key figure I would like to share with you in today’s call, and while there are other figures that would show what we have done, these figures would be much more ambiguous, some could even be used to make our results look “not so hot.” Sequential same store traffic is a like-for-like measure of our number of visits in Q4 compared to Q3. As you can see, we were 21% more trafficked than last quarter, a growth rate which is the best in the Online Financial Humor/Abstract Investment Recommendation Industry.

We generated earnings per a subscriberholder of $0.38 compared to $0.32 in Q3. Our accounts receivable is a little higher than we’d like it to be due to unfavorable payment terms and a one-off timing issue with one of our largest accounts. Working capital was also challenged by our securing of a 5 year extension of our domain registry costs, which was payable up front. Revenue was flat sequentially but our reliance on Yahoo CPC advertising has been reduced and our runrate revenue should be at a higher level. In the Yahoo segment, our click through rate increased 20% sequentially, but that gain was offset by a 34% decrease in our revenue per click. Our suscribership increased from 161 to 282.

We now have $115.56 of Payment-in-Kind (PIK) debt which is off-balance sheet and was previously undisclosed. Management has experience operating in a leveraged environment, and the debt should be reduced substantially by the end of Q1’07 from working capital.

We passed several milestones in our first year, including our 30,000th visit to our new storefront, as well as 100,000th visit overall. We also fell in love. We hope that in the coming year we can repeat what we did well last year, and improve on it, by approximately 5-7% in every measure.

Note that the financials below are unaudited and may contain non-GAAP measures. All numbers comply with Seldom Accepted Accounting Principles (SAAP).

Unaudited Financial Results for Q4’06

- Income Statement

- Contextual CPC Revenue $38.47

- Static Ad Revenue $78.50

- Other Revenue $14.11

- Total Revenue $126.08

- Cost of Sales $19.55

- Marketing Expense $0.10

- Operating Income $101.43

- Balance Sheet

- Cash $0

- Accounts Receivable $190.14

- Inventory $0.00

- Prepaid Hosting/Reg $115.05

- Accounts Payable $0

- Cash Flow Statement

- Operating Cash Flow ($34.83)

- Capex $0.00

- Dividends $X.00

- Performance Metrics

- Visits 16,900

- Pageviews 31,850

- Clicks on ads 100

- Ad impressions served 55,000

- Subscribers by Email 50

- Subscribers by XML 232

- Inbound Links per Technorati 154

- Inbound Links per Google ~71 sites

Past Results (due to our reliance on SAAP, previous unaudited financial results are not reliable)

Long or Short Capital Q1’06 Results

Long or Short Capital Q2’06 Results

Long or Short Capital Q3’06 Results

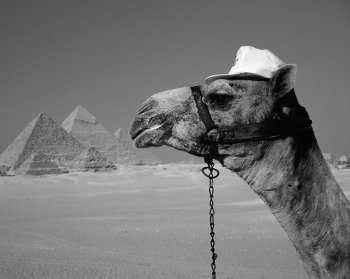

The typical pick-up truck costs you $20k, requires constant refueling, will overheat in the desert, pollutes the earth, cannot discern between Coke/Pepsi, and cannot cure cancer. A fully grown camel costs the USD equivalent of $1300 to $1700 with none of those drawbacks. And for all of that, all he asks is you turn your head once a year while he bangs out the two humped camel babe he met in eastern Turkey.

The typical pick-up truck costs you $20k, requires constant refueling, will overheat in the desert, pollutes the earth, cannot discern between Coke/Pepsi, and cannot cure cancer. A fully grown camel costs the USD equivalent of $1300 to $1700 with none of those drawbacks. And for all of that, all he asks is you turn your head once a year while he bangs out the two humped camel babe he met in eastern Turkey.