July 29, 2014

New Non-SAAP Measure: Net Tweetcome-based Valuation

Long or Short Capital was the first firm to switch its accounting to SAAP. LoS further improved accounting when it added Earnings before Everything (EBE) to the SAAP lexicon. The results are that SAAP is ubiquitous and it’s now quite common for public companies to exclude most expenses when reporting earnings.

After delivering those innovations and after switching to the “royal we”, we looked at potential disruption in the accounting space and started yAccountingStars, an accounting accelerator. We hired hordes of hungry hipsters, who were willing to work for almost nothing so long as we promised them beanbag chairs, organic coffee, and a good work/work balance. We also lied and told them they’d all get equity. (Please don’t txt or tweet this to them, they don’t actually read anything that isn’t a txt or a tweet, so this is safely between you and us here.)

We then asked ourselves: what investor pain-points can we help solve? what kind of onerous constraints does accounting impose? Investors already get SAAP, given that 80% of companies employ SAAP according to a study we might have done. Investors also firmly grasp the value of companies with no reported net income but ample EBE. But what about companies that have huge opportunities but negligible revenue but also have a vigorous twitter account? Why should these companies be left behind?

Following years of R&D and inappropriate workplace behavior at yAccountingStars, LoS is ready to throw such companies a lifeline and introduce Net Tweetcome and Price to Net Tweetcome (P/NT). Net Tweetcome is calculated by taking a CEO’s tweets and then deducting all expenses associated with those tweets. Mathematically (for all the nerds* out there who care about the actual calculations behind made up numbers) this is represented as:

Tweets - 0 = Net Tweetcome

P/NT = Price / Net Tweetcome

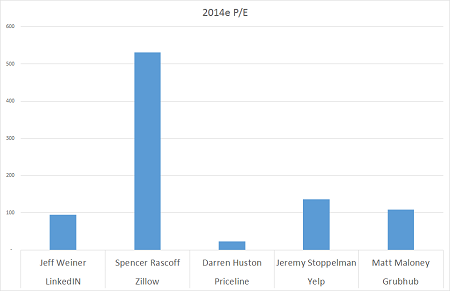

Example: Suppose you are an investor trying to find value in the consumer internet space. There are some companies that have been public for ages like Priceline (PCLN). Then there are newer, Up-and-Comers like Grubhub (GRUB), Zillow (Z), and Yelp (YELP). Which should you buy? A traditional analysis might be based on P/E:

Even though we are using pro forma, EBE-style EPS estimates that exclude all kinds of normal expenses (for instance, the large portion of employee compensation that happens to be paid in stock), the Up-and-Comers carry ridiculous valuations; only Priceline appears to be reasonable. But investors need to own these hot Up-and-Comers…in size. P/E valuations fail us here.

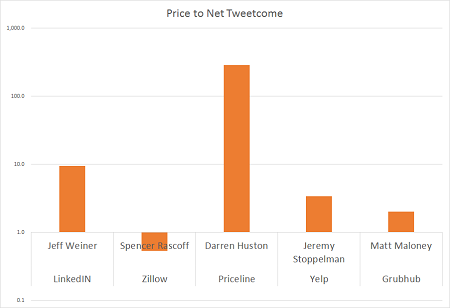

What’s the solution? (spoiler alert: it’s Net Tweetcome):

Note that we have chosen to display this comparison on a logarithmic scale in order to convey a false sense of precision and general maths capability.

P/NT shows that Priceline actually sports the loftiest and most dangerous valuation. While many of the Up-and-Comers sport quite attractive valuations. Zillow is positively cheap on a P/NT basis. Thanks to CEO Rascoff’s unprecedented 5.8 tweets per day, Z looks like a value buy for a progressive analyst capable of spotting their strong fundamental Net Tweetcome. To underscore how cheap it is, if Zillow traded at the same P/NT multiple as Priceline, it would be worth $3.4 trillion dollars and a prospective investor would be served a delicious 65,327% return from today’s trading level. And just think if Rascoff starts live-tweeting all his favorite TV shows: Z could go straight to Perf.

Recommendation: Long Twitter. The gap between reality and Net Tweetcome is highest at Twitter itself. On traditional metrics, is confusing. For instance, in 2013 Twitter managed GAAP net loss of $645mm on revenue of $665mm for a net income margin of negative 97% while, on an EBE basis, they lost $35mm. These are impressive results in their own right; it’s not easy to lose that much money 140 characters at a time. But look…Twitter sent over 200 billion tweets in 2013! That means Net Tweetcome = 200bn tweets – 1.3bn opex** = 198.7bn. That is the highest Net Tweetcome in the world! Twitter is trading at 1/10th of annual Net Tweetcome…we have literally never seen this type of opportunity before and are up to our necks in fictional Twitter stock!

If we can rein in their Tindr activity, we are confident yAccountingStars will have their next report “How to Calculate the Tweetcome TAM for Any Company in 14 Easy Steps” ready shortly.

*Only nerds read footnotes, you nerd.

**Yes, we previously defined Net Tweetcome as “Tweets – 0” but Twitter is the exception that proves the rule. Given that they actually bear the costs to send all tweets, we must dock their Net Tweetcome with operating expenses.